BlackRock: "Private credit will double" RWAs + Stablecoins change the game

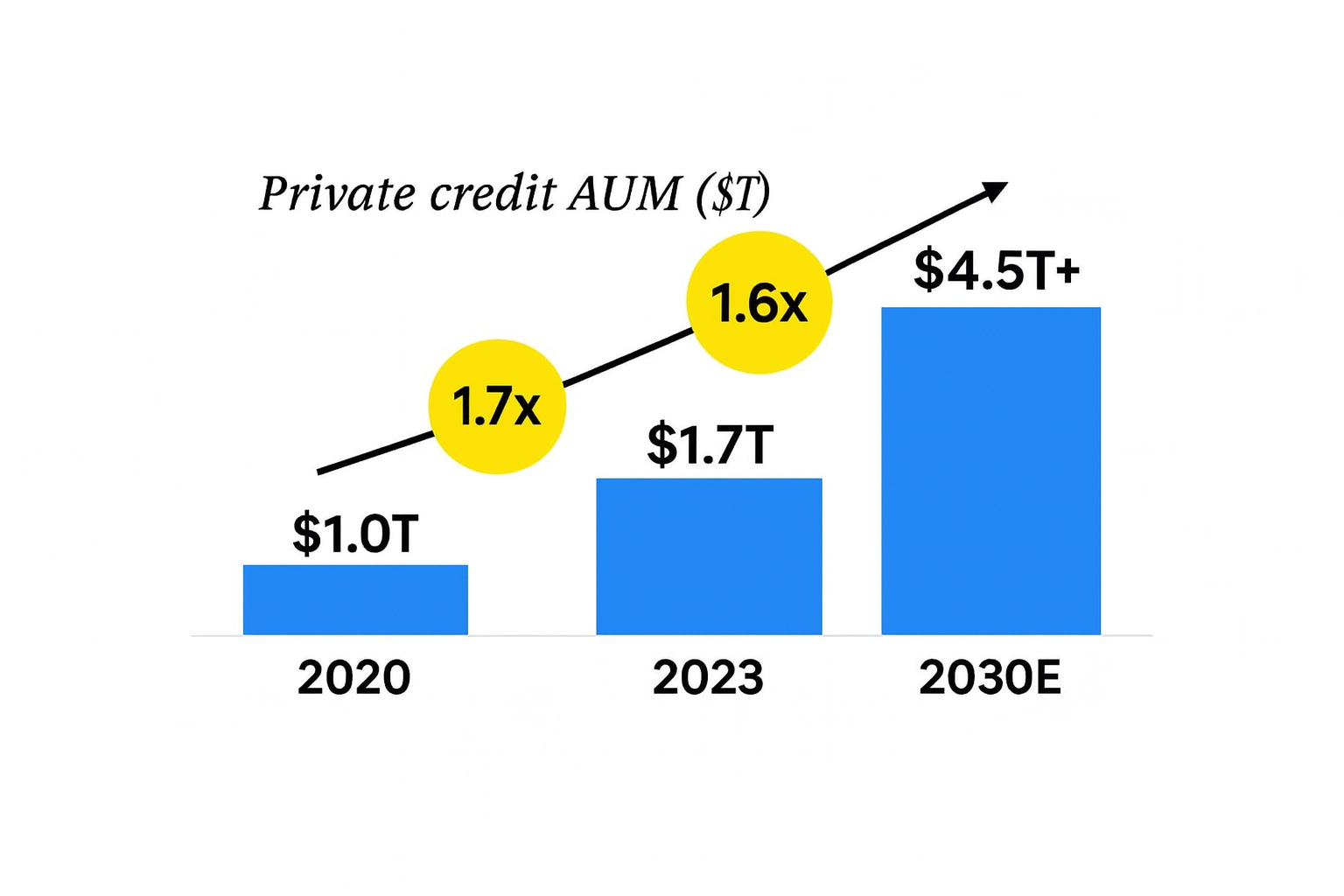

BlackRock has made a clear prediction: the $2.1 trillion private credit market will more than double to $4.5 trillion by 2030.

The message is consistent: global demand for private credit is accelerating, and the financial infrastructure must evolve to support that scale.

This is precisely where tokenisation and stablecoins become critical.

They provide the technological foundation needed to expand access, improve liquidity, automate servicing, and reduce operational friction - all prerequisites for private credit to grow at the rate BlackRock forecasts.

Within this new infrastructure, tGBP plays a crucial role as the GBP on-chain settlement rail.

Private credit markets increasingly require instant GBP-denominated transfers, yield distribution, collateral movement, and capital calls - all of which tGBP enables with 24/7 settlement, reduced costs, and programmable money flows.

As more GBP-based private credit activity moves on-chain, tGBP becomes the essential liquidity layer connecting investors, originators, and credit protocols.

1) Tokenisation Unlocks Access to Private Credit

Private credit has historically been: illiquid, inaccessible and administratively expensive

Tokenisation fixes this by making credit programmable and tradable

Key Impacts:

- Fractional ownership → smaller ticket sizes → broader investor base

- Automated compliance (KYC/AML enforced by smart contracts)

- Secondary market liquidity → tokenised credit becomes tradable

- Real-time reporting + transparency → lower operational risk

- Global distribution → investors anywhere can participate (subject to compliance)

Tokenisation solves private credit's biggest constraint: limited distribution capacity.

2) Stablecoins Enable Faster, Cheaper, Global Capital Movement

Private credit relies on:

- capital calls

- interest payments

- principal repayments

- cross-border transfers

- settlement and reconciliation

Traditional rails are slow and expensive.

Stablecoins fix this:

- Instant GBP, USD, or EUR settlement

- Lower FX and wire costs

- 24/7 movement of capital

- Reduced counterparty and settlement risk

At scale, shaving even 10–20 bps in operational friction is massive.

Stablecoins make private credit scalable.

3) On-chain Private Credit = Transparency → Lower Risk Premiums

Tokenised, real-time-updated, on-chain serviced credit increases transparency, enabling:

- lower risk premiums

- reduced cost of capital

- increased investor appetite

- better pricing efficiency

Better transparency = more institutional comfort = more capital = bigger markets.

4) Reduced Administrative Load = Higher Scalable AUM

Today’s private credit ecosystem is clogged with manual processes:

- reconciling loan ledgers

- servicing payments

- managing waterfall structures

- executing compliance workflows

- producing NAV reports

Tokenisation solves this.

Smart contracts automate:

- interest distribution

- principal repayment

- loan servicing

- NAV calculation

- reporting

- compliance validation

This makes it economically viable for asset managers to scale into thousands of smaller, diversified private credit positions, all of which are previously impossible.

Tokenisation reduces marginal cost, a requirement for AUM to double.

5) Tokenised Cash + Tokenised Credit = A Closed-Loop Financial System

BlackRock’s long-term strategy clearly signals a future where:

- assets are tokenised (credit, PE, real estate, infrastructure)

- cash is tokenised (stablecoins, tokenised deposits)

- settlement is on-chain

- liquidity is global and programmable

The flywheel:

More tokenised assets → more stablecoin usage → deeper liquidity → lower friction → more capital → larger private credit markets.

Stablecoins and tokenised assets reinforce each other.